Primary Market Definition and Functions

Primary Market Definition – A market which deals with buying of new or fresh securities for the first time.

The primary market deals with the issue of new securities , that is, securities which are not previously available. It provides additional funds to the issuing companies. The fund can be used for starting a new enterprise ,expansion or diversification of the existing one. The money that firms raise from primary market is a direct financing.

The primary market have no geographical existence. It existence depends upon services it renders to lenders and borrowers. Hence, also known as new issue market or initial public offering.

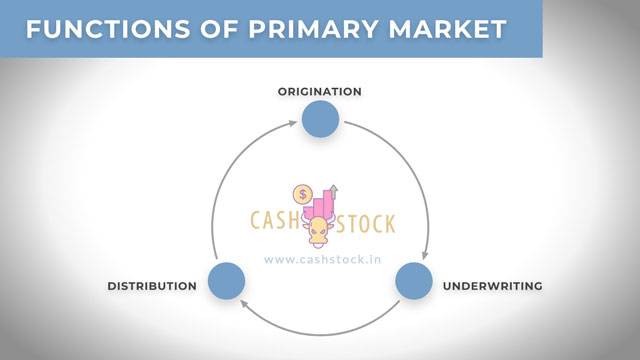

Functions of primary market

To understand the primary market definition in depth, let’s also discuss the functions of primary market. The general function of primary market is to channelize funds in to industrial enterprises. There are three functions of primary market which are given below –

1. Origination

The term origination refers to the work of investigation and analysis and processing of new proposals. Specialist agencies perform these functions which act as sponsors of the issue. The preliminary investigation entails careful study of technical, economical, financial, and legal aspects of the issuing companies.

This is to ensure that it warrants the backing of the issue houses in the sense of lending their name to the company. Thus, give the issue the stamp of respectability. It shows company is strong, has good market prospects and is worthy of stock exchange quotation.

In the process of origination the sponsoring institutions render, as a second function, some service of an advisory nature which goes to improve the quality of capital issues. These services include advice on such aspects of capital issues as:

(i) determination of the class of securities that are going to issue and price of the issues in the light of market conditions”

(ii) the timing and magnitude of issues,

(iii) methods of flotation, and

(iv) technique of selling, and so on market.

2. Underwriting

In order to get the success of the issue, underwriters came into role. They guarantee the selling of the issue in case it is not subscribe by public. Hence eliminates the risk of uncertainty. Underwriting service is significant for both company as well as public. Company gets money and public get free of over stress.

3. Distribution

The sale of securities to the ultimate investors is known as distribution. It is a specialist job which is performed by brokers and dealers in securities. They maintain direct and regular contact with the direct investors.